Pre-Market Prep

Fundamentals

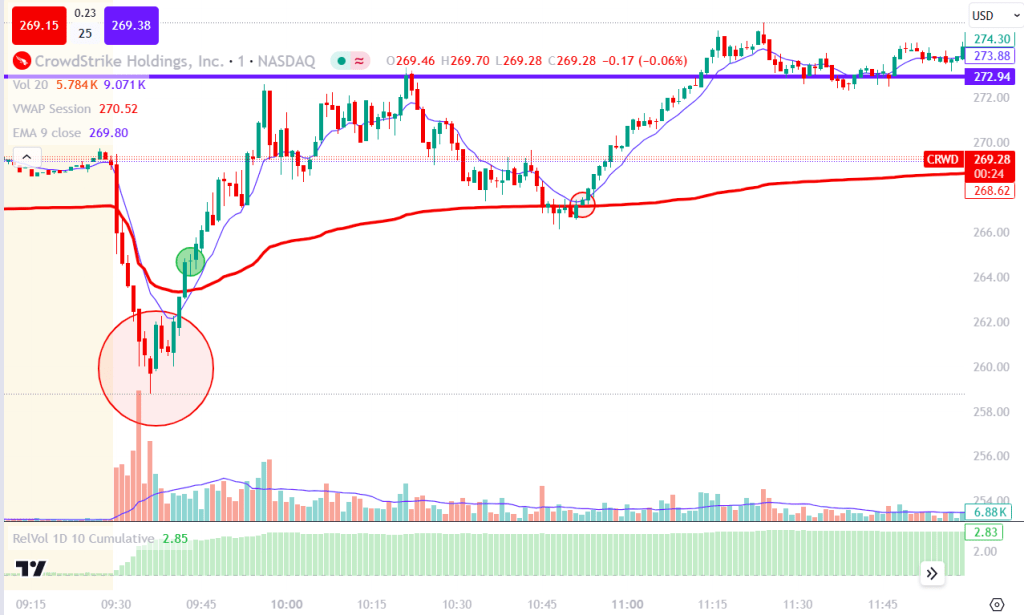

Today is the third trading day following the CrowdStirke software crash. A major outage impacting Microsoft-powered systems caused disruptions across various sectors, including airlines, banks, and publishers worldwide. Both governments and airlines pointed to CrowdStrike as the source of these issues.

Technicals

There was not a lot of activity in the pre-market; however, we saw a quick increase to 2 RVOL off the open.

Post Trade Review

CRWD opened with a significant drive to the downside, then reversed after a large bullish candle cleared the highs of the previous two candles. Although this candle resembled a rubber band scalp entry, we were too close to VWAP to achieve a favorable risk-to-reward ratio. I did not enter here, but I did note it as a reversal signal. We then broke through VWAP, where I entered a long position (marked by the green circle). I took profits on the first pullback and the extension up to the blue level. I completely exited during the first rejection of the key level. This was a very successful trade, especially since it moved in my favor immediately. Using the 9 EMA for trend following was advantageous. Shortly after, the price returned to VWAP and bounced cleanly. I didn’t enter this trade, but this would have been an excellent opportunity for another long position. My final thoughts are that the failed opening drive pattern is becoming easier and easier to recognize. I am creating a list of screenshots here: Opening Drive Fail. Quickly viewing these images everyday has given me the confidence to enter without hesitation. I will continue to add to this list of screenshots every time I spot this setup.

Leave a comment