Pre-Market Prep

Fundamentals

On Friday, July 19th, CrowdStrike’s stock experienced a significant drop, marking its worst single-day performance in over 19 months. A major outage impacting Microsoft-powered systems caused disruptions across various sectors, including airlines, banks, and publishers worldwide. Both governments and airlines pointed to CrowdStrike as the source of these issues. CrowdStrike’s stock plummeted by 11.1% on Friday, its steepest one-day decline since November 30, 2022, when it fell by 14.8%.

Technicals

On the daily chart, we approached a previously tested zone (indicated by the blue line). I had identified this zone as a potential target or resistance area.

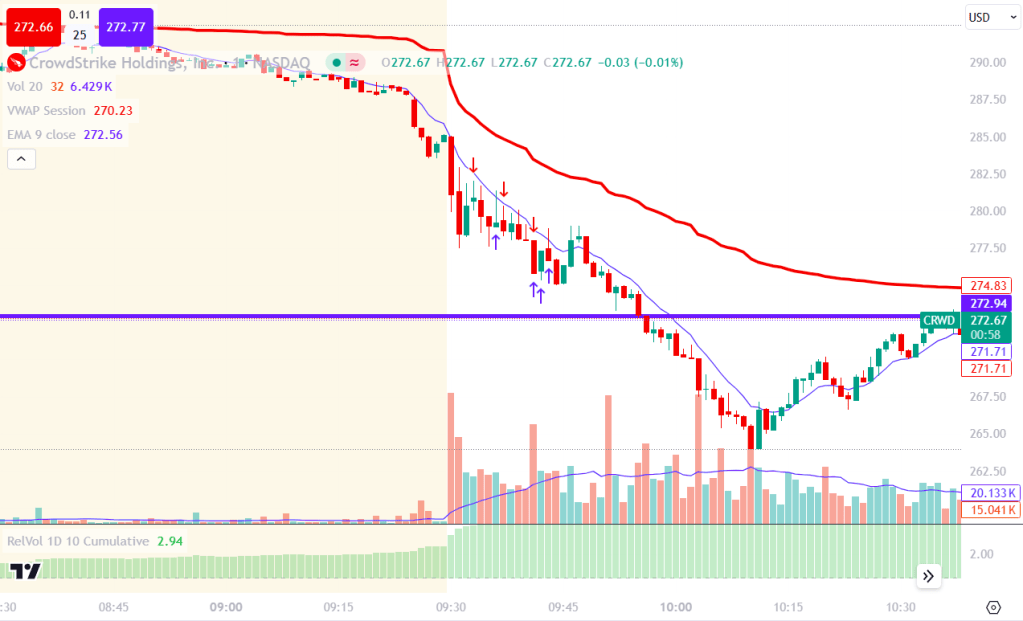

In the pre-market, it was evident that sellers were in control, maintaining the VWAP level. We were also trading at approximately 2 RVOL, with this figure continuing to rise as the market opened. This indicates strong ongoing interest in the stock, even after the significant activity on Friday.

Post Trade Review

Below is a screenshot showing my trade entry. There was a significant sell-off towards the end of the pre-market and into the market open. Although I experienced some FOMO, I recognized this pattern and waited for the pullback. I entered at the peak of the pullback (marked by the first red arrow on the chart). While this was an ideal entry point, I exited prematurely as the price didn’t move immediately in my favor. I re-entered and covered twice more. The trade was profitable, but not optimal. A better trade would have been to hold my initial position until the price broke the 9 EMA, perhaps selling half or three-quarters of my position to mitigate risk and lock in profits, and then letting the remainder ride until the next 9 EMA break.

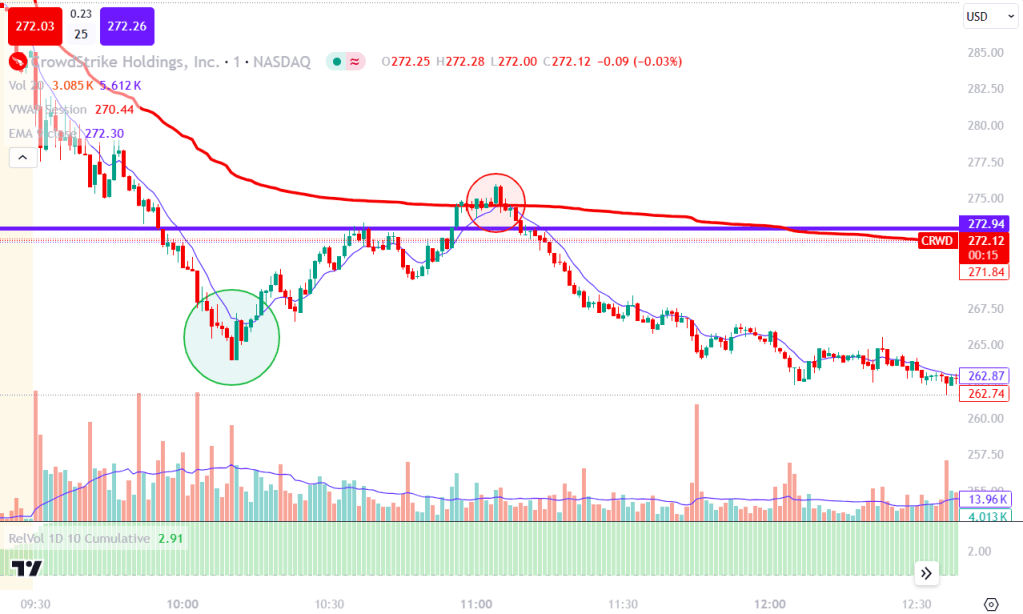

In the chart below, the first circle indicates a rubber band scalp entry. I would rate this as a B setup at best, as the price didn’t even break the 9 EMA, which it had been following, and there wasn’t significant volume to clear the highs of the previous two candles. If you did enter, you could have ridden the position to the VWAP; however, I would have been cautious after the 9 EMA broke during the pullback towards VWAP. Another possible entry was the perfect rejection of VWAP. The price moved up to VWAP, showed a strong bullish candle holding above it, but was immediately followed by an engulfing bearish candle rejecting VWAP. This would have been an ideal entry for a short position.

Leave a comment