Pre-Market Prep

Fundamentals

Shares in Trump Media & Technology Group Corp (DJT) soared in Monday’s premarket trading following a dramatic weekend. Authorities are currently investigating an incident that they are treating as an assassination attempt on former U.S. President Donald Trump.

Technicals

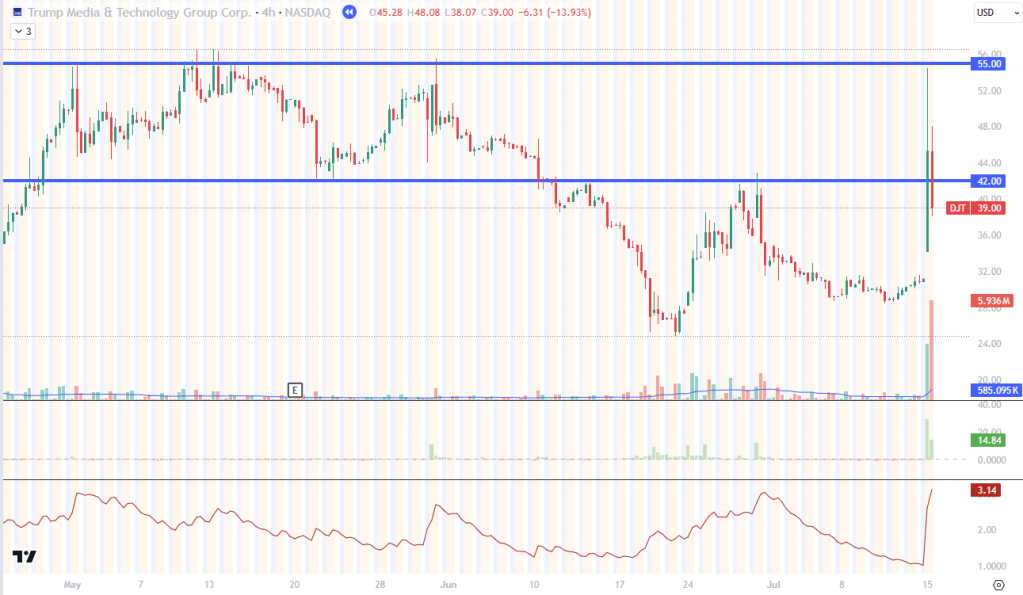

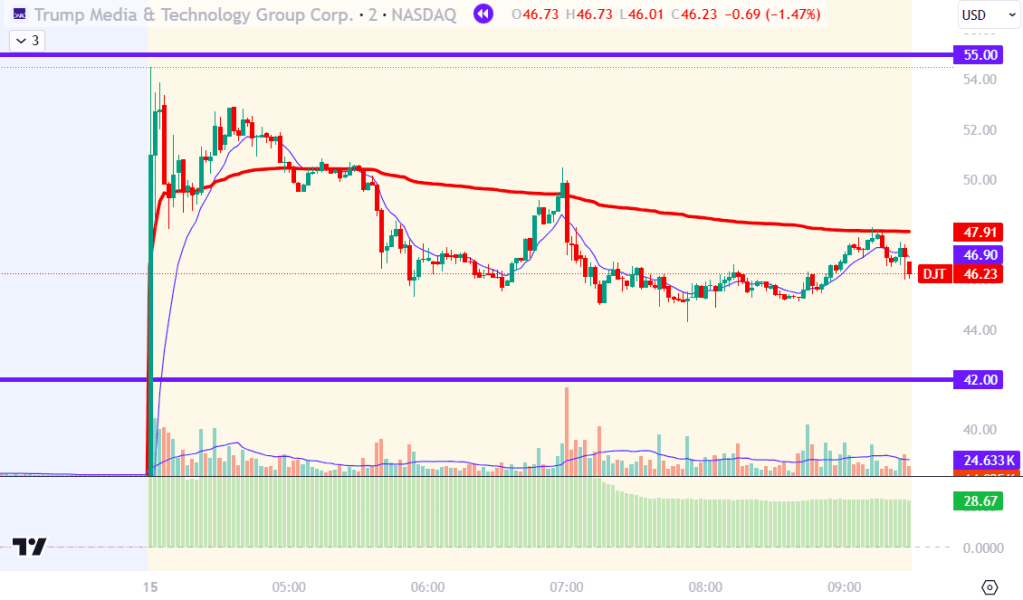

Following this big fundamental news catalyst, DJT opened 50% higher than the close on Friday afternoon. Furthermore, it was trading around 20X RVOL going into the open. During the pre-market we cleared an important resistance level at 42 and tested the 55 level.

Despite the gap up there was clearly a lot of sellers holding VWAP.

Post Trade Review

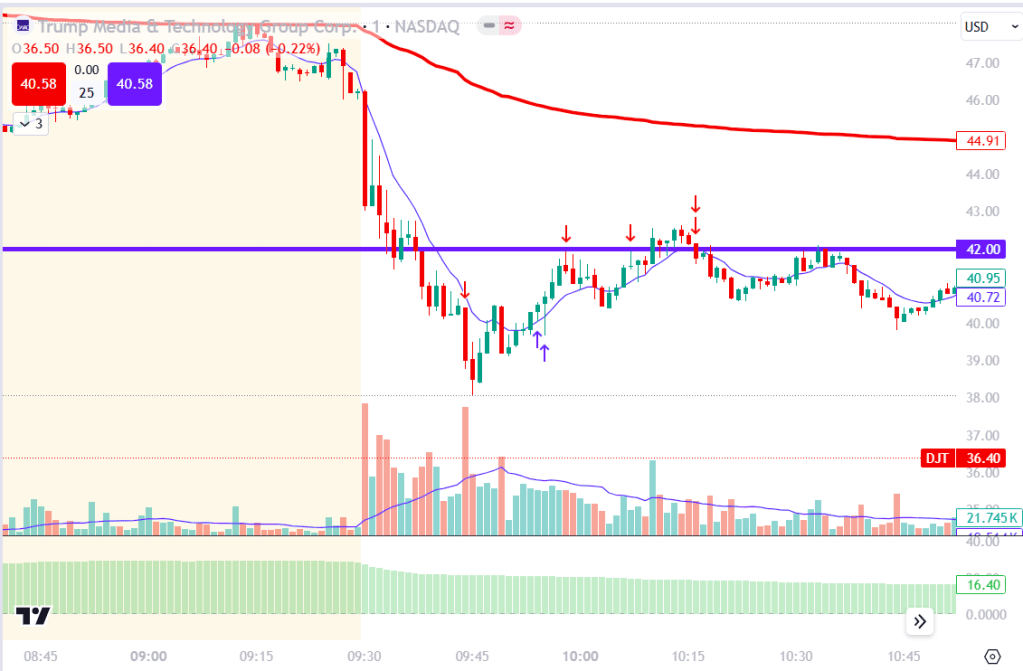

My original trade idea was to short off a VWAP test and rejection. Looking back, the only real entry point was in the pre-market. As you can see, the price came up and tested VWAP on three separate occasions, each time failing to hold. The third test, just before the market opened, could have been a good play to enter short with a very strict stop above VWAP.

I followed my trading rule not to trade in the first 5 minutes, which was a smart move because there was no good entry without taking on excessive risk. Unfortunately, I let FOMO get the best of me and shorted at the bottom of a large red candle. Because of this, I am making a new rule: not to enter a trade on large candles that require a large stop. Instead, I should enter on the consolidation before the move.

I ended up exiting that trade but immediately flipped to a long position once we made a new higher high and higher low. This trade is what Lance Breitstein calls the “right side of the V,” and I was pleased that it worked in my favor. I took profits (1/4 position at a time) when we started to hit resistance at the 42 level and eventually closed my positions when we couldn’t hold above 42.

All in all, it was a good trade, and I liked that it was a quick trade that worked immediately in my favor.

Leave a comment