Pre-Market Prep

Fundamentals

Yesterday, June 25th, after the market close, FedEx (FDX) announced very positive earnings. They had estimated $5.338 per share but reported $5.41 per share, resulting in a 1.34% surprise.

FedEx, which lost a key contract with the United States Postal Service to its now-larger rival, United Parcel Service (UPS), has been focusing on cost cuts and efficiencies under CEO Raj Subramaniam. This shift follows pressure from activist investors last year. The company has reduced headcounts in Europe and the U.S. and is committed to achieving around $4 billion in overall cost reductions by the end of the next fiscal year, with about half of that amount already realized.

Technicals

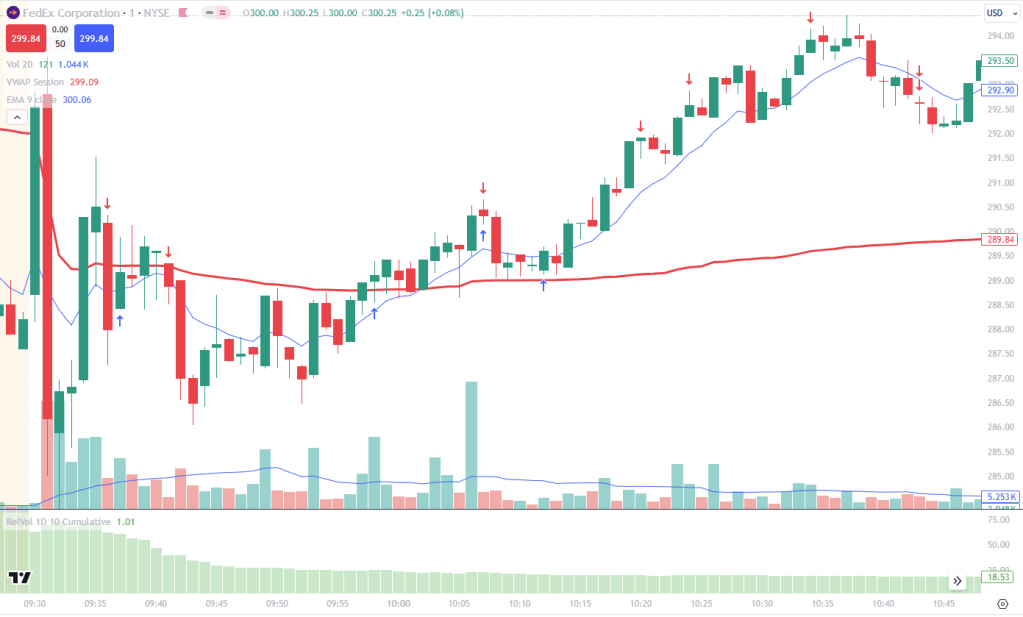

FedEx (FDX) jumped 16% in the post-market, rising from its closing price of $256.46 to a high of $298.91, nearing its all-time highs, following the positive earnings report. In the pre-market, it traded at approximately 60 times the usual volume and showed strength until a significant sell-off occurred heading into the market open.

VWAP Strategy

- The stock is trading at high RVOL in the premarket (At least > 2)

- The stock should have a good news catalyst.

- The stock should have a powerful opening drive.

- Pullback to VWAP on lower volume than the opening drive.

- Push a way from VWAP (wicks on the candle).

- RVOL should still be elevated during the trade.

- Stop loss initially will go above VWAP but move the stop loss down after each new prominent high/low.

Post Trade Review

FDX traded up and down a full daily ATR during the opening drive. I have a rule not to trade in the first 5 minutes, so I didn’t enter a short position until the 6th minute. This was premature, and I closed out on the next candle. I then tried to short again when we were holding below VWAP. This trade initially moved in my favor for about 2 points, but I was greedy and didn’t take any profits, eventually getting stopped out when the price moved back above VWAP.

When the price held above VWAP, I entered long twice. The first time, I closed out immediately because I was pretty extended from VWAP. Fortunately, the price returned to VWAP, where I could enter close to it. This has definitely been a learning process. I get excited to enter on a large bounce from VWAP, but that increases my risk since my stop goes below/above VWAP, depending on the trade. Therefore, I am trying to develop a rule for how close to VWAP I want to enter, perhaps something like not entering if it’s greater than a 1-minute ATR or something similar.

Below are my trade executions. The red arrows indicate short positions, and the blue arrows indicate long positions. On my last trade, I took profits five times, each for 1/5 of my original position. I used Bookmap to help determine where the liquidity was, and it was very helpful in keeping me in the trade longer.

I have also started recording my trades so I can review them later. This is a valuable practice, similar to what some of the greatest football players do to constantly improve their game.

Leave a comment