Pre-Market Prep

Fundamentals & Technicals

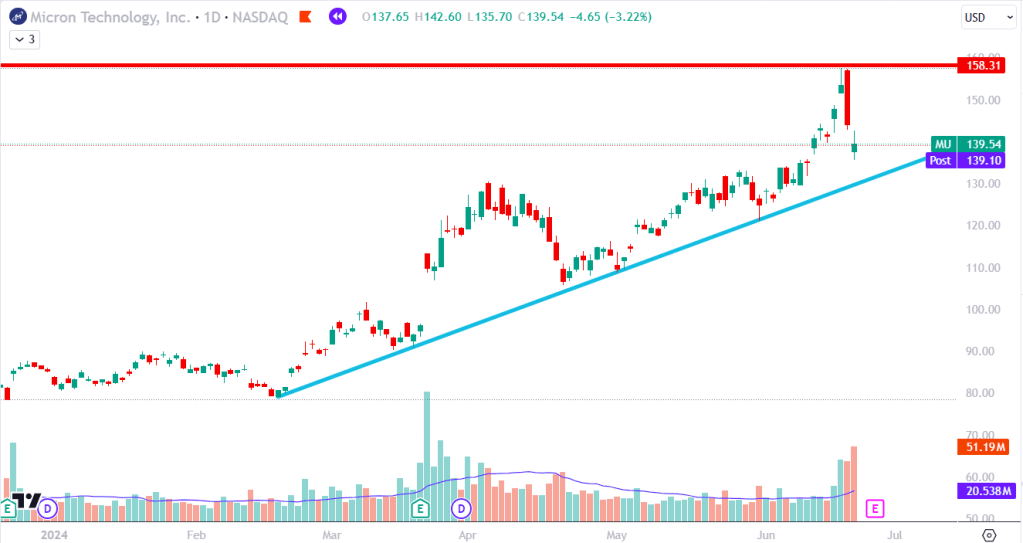

MU has been in a strong uptrend for the past few months. However, last Thursday, the stock experienced a significant sell-off from its all-time high. This decline was consistent with the broader semiconductor market, likely triggered by NVDA’s sell-off due to overextension.

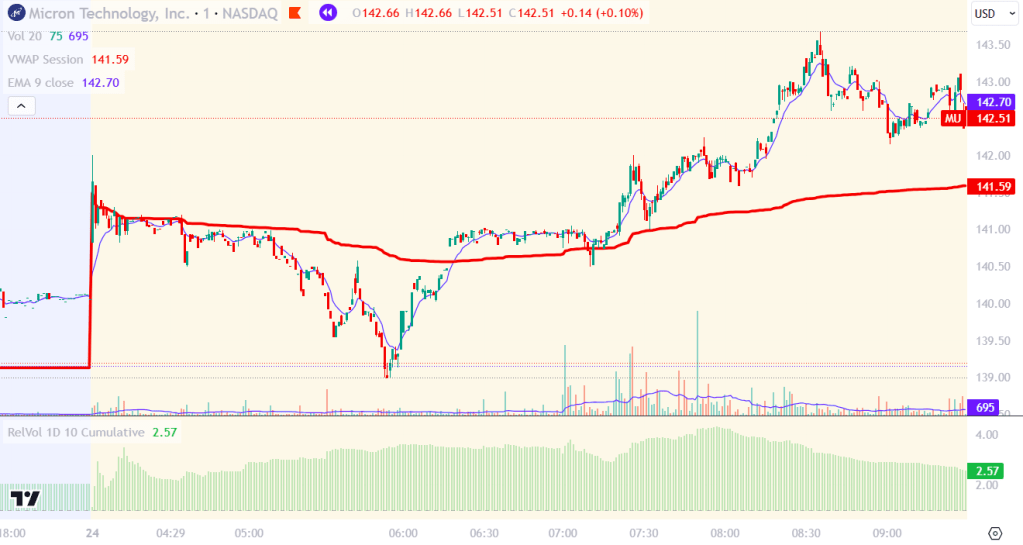

Going into the premarket, MU was trading at significantly high premarket volume (2.5-4x) and trending up from Friday’s close.

VWAP Strategy

- The stock is trading at high RVOL in the premarket (At least > 2)

- The stock should have a good news catalyst.

- The stock should have a powerful opening drive.

- Pullback to VWAP on lower volume than the opening drive.

- Push a way from VWAP (wicks on the candle).

- RVOL should still be elevated during the trade.

- Stop loss initially will go above VWAP but move the stop loss down after each new prominent high/low.

Post Trade Review

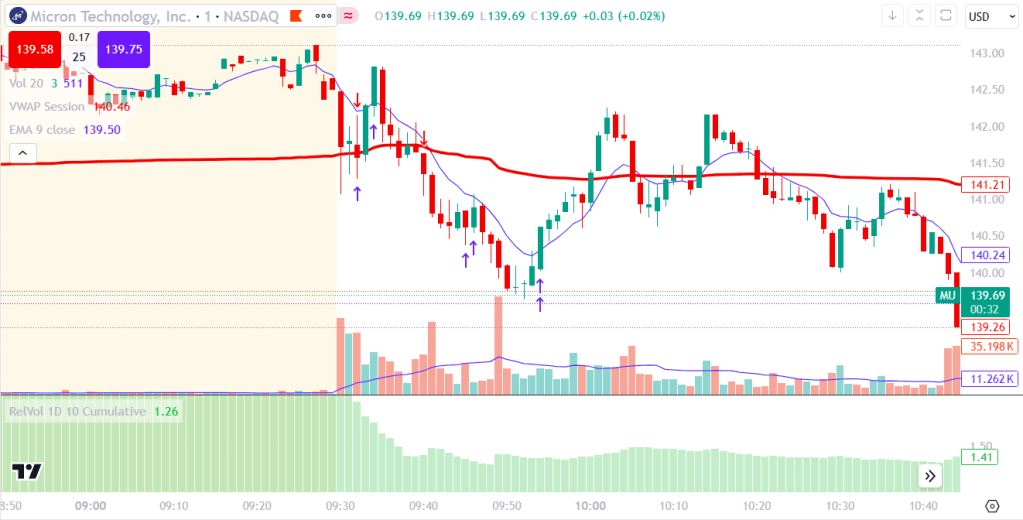

My entries are in table format below. The blue arrows on the chart represent long positions and the red arrows represent short positions. The red line is VWAP, and the blue is the 9 EMA.

| Position Type | Entry | Exit |

| Long | $142.12 | $141.51 |

| Long | $142.34 | $141.53 |

| Short | $141.53 | $140.43, $140.93, $140.36, $140.63 |

When MU opened, I noticed it was holding above VWAP, so I attempted to go long on the third candle of the session but got stopped out. I tried another long position on the fourth candle after a large pop off VWAP but decided to flip my position to a short when the price stayed below VWAP.

Let’s start with what I did well. Switching my position to a short after two failed long attempts demonstrated good trading discipline. Not getting stuck in the mindset that I had to be right and instead listening to the market helped me recoup some losses from the initial trades. I also observed a slight increase in volume under the VWAP, which confirmed my decision to enter the short trade.

Now, let’s discuss what I didn’t do well. I entered a position without a clear narrative of who was in control. Entering on the large pop was a mistake for two reasons. First, this entry increased my risk by about 20 cents compared to the first trade because of the higher entry point. I need to enter as close to VWAP as possible. Second, the volume on this bar was significantly lower than in the first three minutes, which should have been a red flag to avoid the trade. Historically, I haven’t traded successfully within the first five minutes of the market opening. Therefore, I’m setting a new rule to not trade until after 9:35. This change should help me avoid getting into tricky trades.

Even though the short trade worked out, the profit was minimal. The rest of the day was pretty choppy, as shown below.

Leave a comment