Pre-Market Prep

Fundamentals

Apple’s annual WWDC event on June 10th brought a series of highly anticipated announcements for investors and Apple enthusiasts alike.

In a captivating virtual keynote, CEO Tim Cook and his team introduced Apple Intelligence, marking the company’s much-awaited venture into generative artificial intelligence. This includes a revamped AI-powered Siri, set to deliver enhanced voice capabilities across Apple’s devices.

Additionally, the company revealed plans to integrate ChatGPT into the upcoming versions of Apple’s operating systems, promising an even more seamless user experience.

Technicals

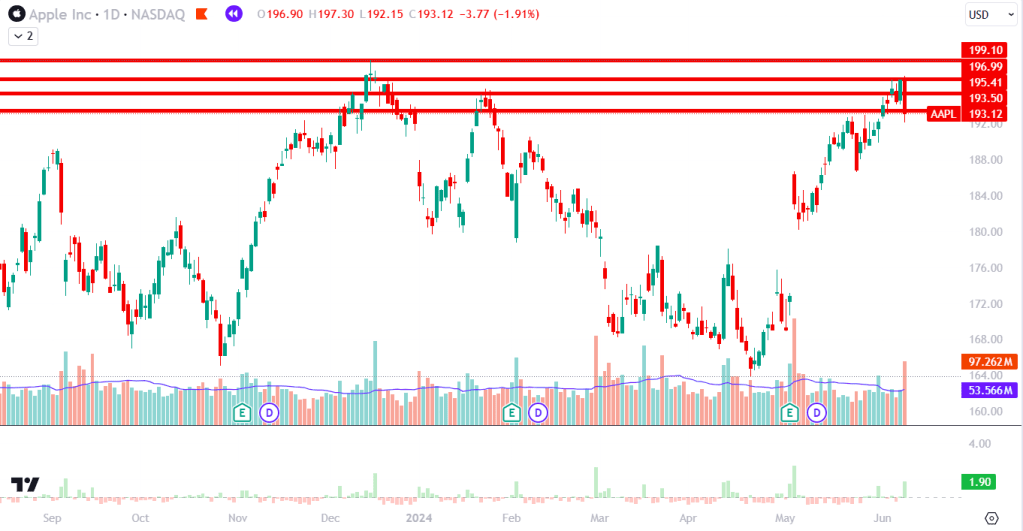

AAPL was clearly in an uptrend, approaching the all-time high of 199.10, a level last tested in December 2023.

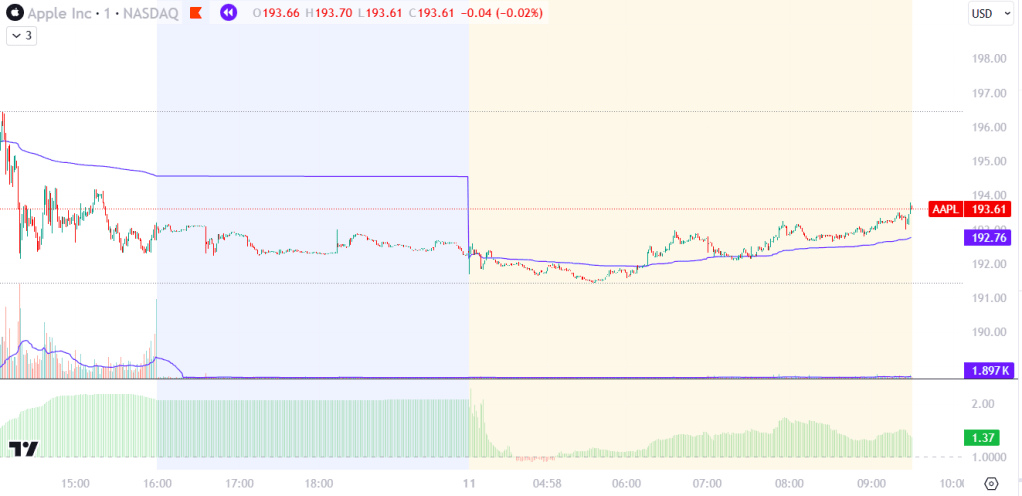

In the premarket, it was trading above the VWAP (blue line) with slightly elevated volume. However, I didn’t place much significance on the news catalyst and wasn’t watching the opening.

SMB Spencer Scalp Strategy – “A” Setup

- The stock is trading at high RVOL (At least > 2)

- The stock should have a good fundamental news catalyst (i.e. Earning, Changing News).

- The stock should clearly have sustained and consistent buying pressure towards the level.

- The stock breaks above the higher time frame level

- If the stock starts to consolidate above the level, creating a range, map out the range and put your stop 2 cents below the bottom of the range. Sometimes trading algos will go into passive buying before reentering active buying phase, which creates consolidation.

- Take 1/4 of position off at first measured move, 1/2 at second measured move, 1/4 at third measured move. Move stoploss up to breakeven at first take profit.

- Another version of this would be the day two play, where on day one the stock does not really move from the news catalyst.

SMB Spencer Scalp Strategy – “B” Setup

- Same as “A” Setup except the stock can have a fundamental or technical catalyst (i.e. breakout of technical level)

- We also open the “B” setup to a trending day in the market or after a failed breakout

Post Trade Review

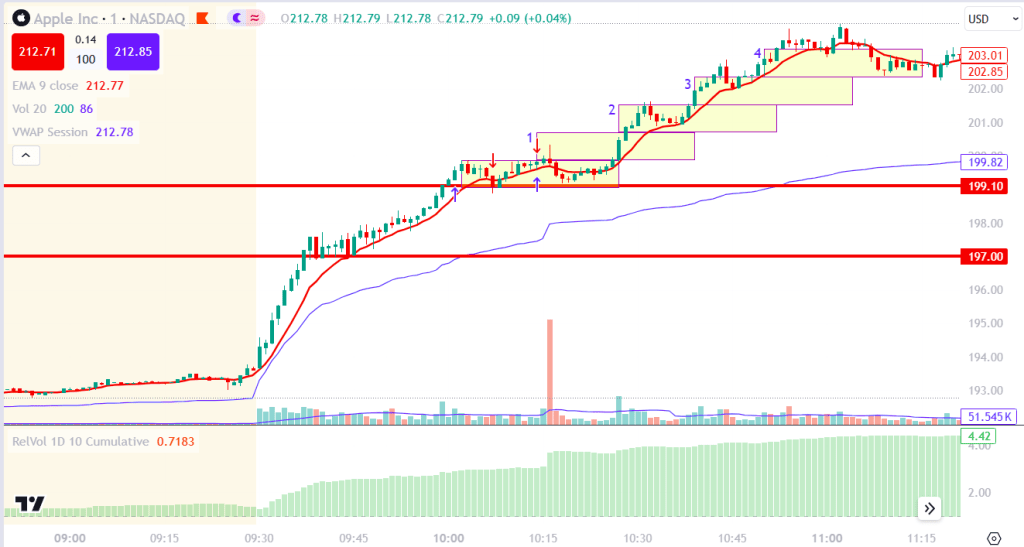

AAPL experienced a significant surge in the morning, breaking through and holding the 197 level. I was eager to enter at this point but hesitated due to the large resistance level ahead. This hesitation was a mistake; I knew we had the potential to reach that level, but I was uncertain about breaking it. Nonetheless, it would have been a nice scalp of about 1.5 points.

My reluctance was also fueled by a fear of losing more money, as I was already drawing down from my previous trades on KWE. I shouldn’t have let this fear hold me back. When we finally crossed the 199.10 level, I went long with a stop below the level but got wicked out. I reentered as we moved higher but prematurely exited because I was afraid of further losses. As you can see, AAPL took off, climbing through four measured moves before breaking the 9 EMA.

My biggest flaw today wasn’t my execution but my mindset. I had the right setup but was afraid to lose more money. I must accept that getting stopped out is part of the game. Getting stopped out is okay; what is not okay is missing “A” setups because I’m afraid to lose money.

Overall, I really liked this setup. It made a lot of sense to me. This trade was definitely easier, knowing that AAPL was about to break to an all-time high, and if it broke, there would be no resistance in its way. Finding levels like this on less clean stocks might be more challenging, but I think if I stick to higher time frame (daily) levels, there could be an edge to that strategy.

Leave a comment