Pre-Market Prep

Fundamentals

WESST Micro Systems Inc. (KWE) has proudly announced a significant achievement: the company has been awarded a sub-contract by Thales Canada. This sub-contract involves delivering specialized software services as part of the Canadian Department of National Defense Land C4ISR series of contracts. The primary goal is to enhance the Canadian Army’s operational capabilities through advanced systems for command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR). The contract was officially signed at the close of business on June 7, 2024.

This award constitutes a task-based contract with a potential maximum workshare of approximately $48 million CAD over an initial six-year term. KWESST’s revenue from this contract will be determined by the timing and scope of task orders issued by the customer. As tasks are authorized and work commences, KWESST’s Management will provide guidance on the expected revenue impact from these activities.

Technicals

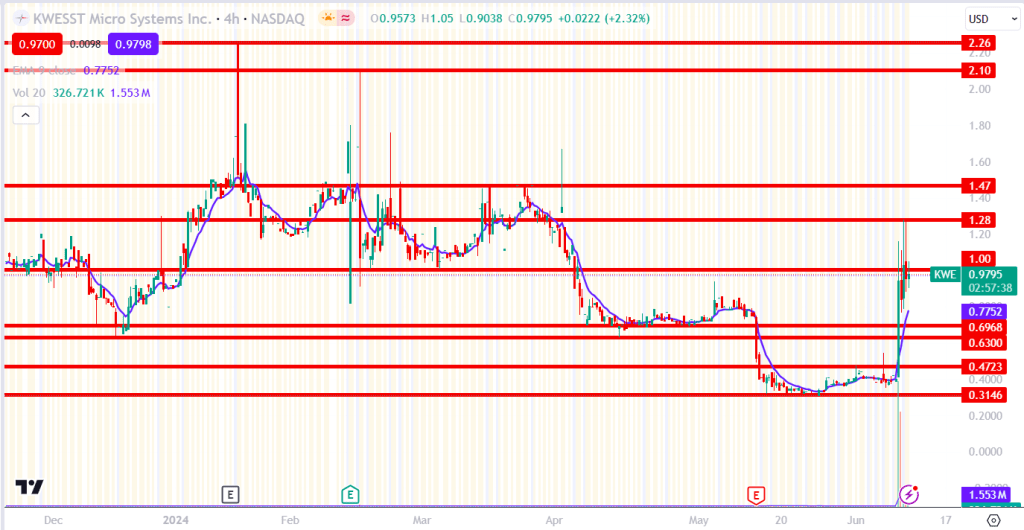

KWE surged to a new high in pre-market trading following the announcement of their $48 million contract. The stock experienced a significant gap up of over 18%, accompanied by massive pre-market volume. Early in the pre-market session, trading volume was 2,000 times higher than usual, but this dropped considerably as the market open approached, stabilizing at around 7 times the normal volume. The $1.00 level emerged as a crucial point in pre-market trading. If the stock could maintain this level and stay above the VWAP, it would present a long opportunity up to $1.28. Conversely, if the stock failed to hold this level and was rejected by the VWAP, it would indicate a short opportunity down to $0.6968.

VWAP Strategy

- The stock is trading at high RVOL in the premarket (At least > 2)

- The stock should have a good news catalyst.

- The stock should have a powerful opening drive.

- Pullback to VWAP on lower volume than the opening drive.

- Push a way from VWAP (wicks on the candle).

- RVOL should still be elevated during the trade.

- Stop loss initially will go above VWAP but move the stop loss down after each new prominent high/low.

Post Trade Review

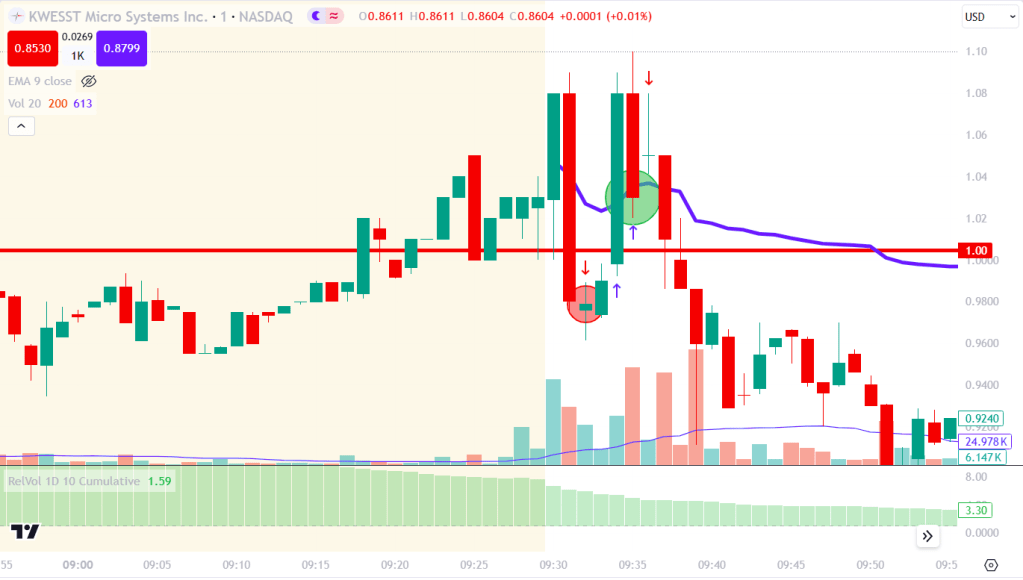

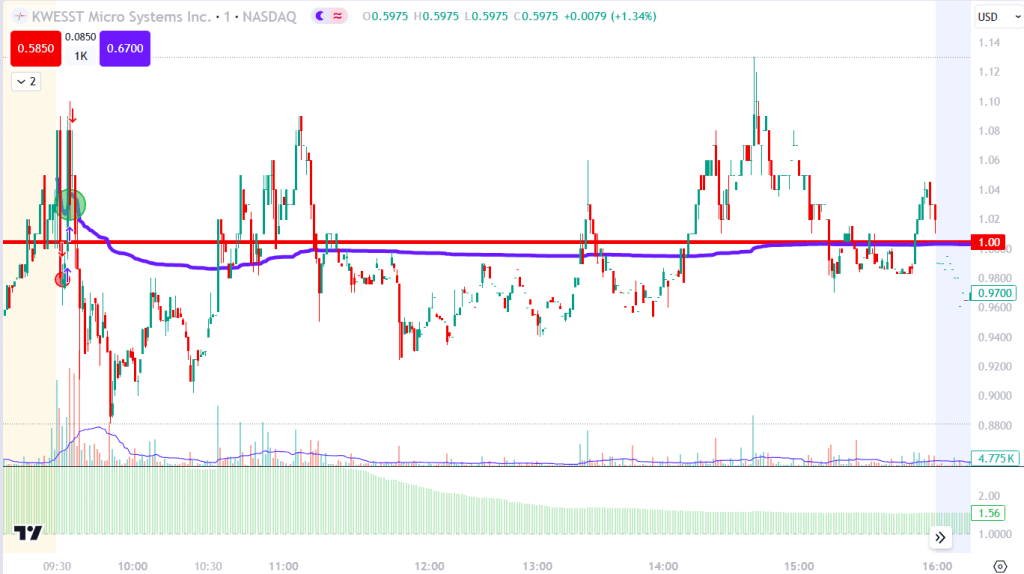

KWE opened strong, surging nearly a full ATR before pulling back through the VWAP. I initiated a short position at this point (marked by the red circle). However, a few minutes later, a large bullish candle pushed the price above VWAP, causing me to stop out and reverse to a long position (marked by the green circle). Unfortunately, the price reversed again, stopping me out. Hesitant to re-enter a short due to my previous failed trades, I missed an opportunity that would have yielded a modest 10-cent gain before reversing. The price action on this stock was erratic and challenging. Even later in the day, potential VWAP plays did not materialize effectively.

Going forward, I may want to avoid low-float, low-price stocks. The float of a security measures the total number of shares available for trading, which directly impacts the market’s liquidity for that stock. Higher float means greater liquidity, making it easier to buy and sell shares without significantly affecting the price. For example, KWE has a float of 3.72 million shares, while TSLA has a float of 2.77 billion shares—highlighting a substantial difference in liquidity. With more shares available, stocks like TSLA tend to exhibit more stable price movements compared to low-float stocks like KWE.

Leave a comment