Pre-Market Prep

Fundamentals

Elliott Investment Management, a hedge fun led by billionaire Paul Singer, has acquired a nearly $2 billion stake in Southwest Airlines Co. (NYSE: LUV). This significant investment signals Elliott’s intent to advocate for strategic changes aimed at boosting the airline’s underperforming shares.

Elliott Investment Management, well-known for its influential activism, frequently targets underperforming companies across various sectors. The firm’s approach often involves pushing for substantial organizational changes, including management overhauls and, in some cases, outright sales.

Elliott’s recent engagements highlight its impact on corporate leadership. Companies such as Crown Castle, NRG Energy, and Goodyear Tire & Rubber have experienced CEO replacements following Elliott’s involvement. This pattern suggests that Southwest Airlines may also undergo notable leadership and operational changes as Elliott seeks to improve the airline’s performance and shareholder value.

Technicals

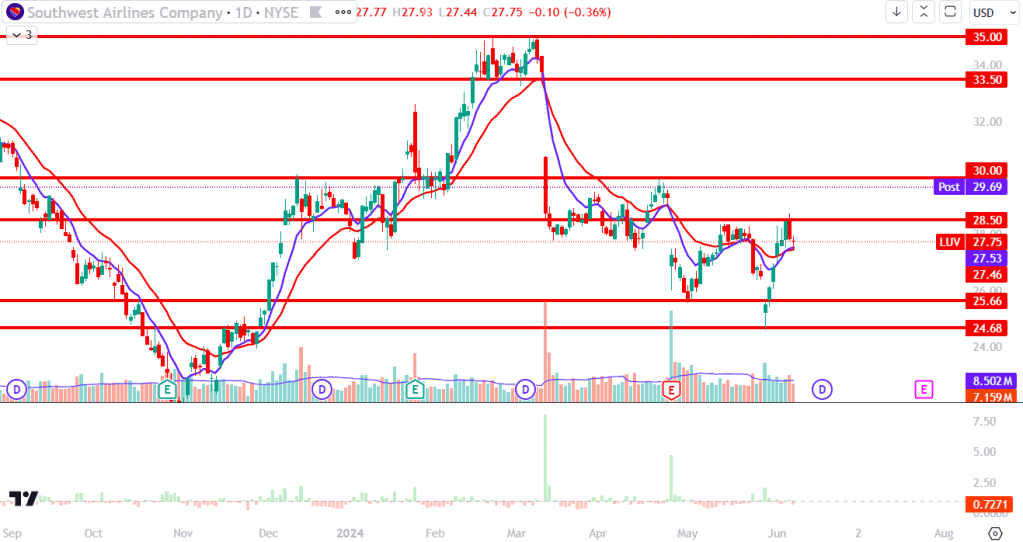

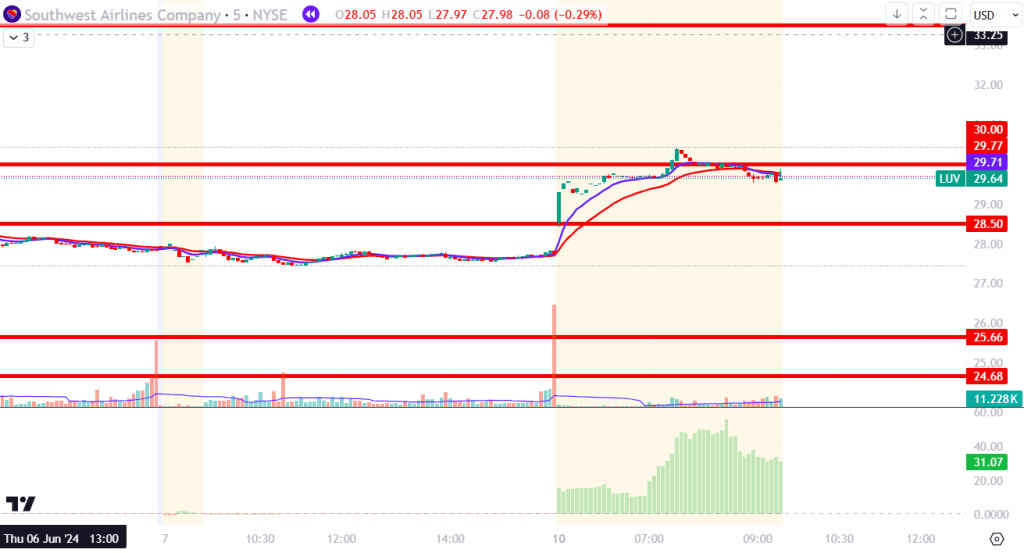

In the pre-market session, LUV experienced a notable surge, gapping up by 6.25%. The stock also traded at a significantly high Relative Volume (RVOL), between 30 and 50 times the usual volume, indicating substantial investor interest.

Key levels on the chart included:

- $28.50: This level acted as resistance which LUV successfully broke above in the pre-market.

- $30.00: A previous resistance level and a significant psychological benchmark for traders.

- $33.50: Representing the bottom of a prior consolidation zone and the closing of the daily gap.

VWAP Strategy

- The stock is trading at high RVOL in the premarket (At least > 2)

- The stock should have a good news catalyst.

- The stock should have a powerful opening drive.

- Pullback to VWAP on lower volume than the opening drive.

- Push a way from VWAP (wicks on the candle).

- RVOL should still be elevated during the trade.

- Stop loss initially will go above VWAP but move the stop loss down after each new prominent high/low.

Post Trade Review

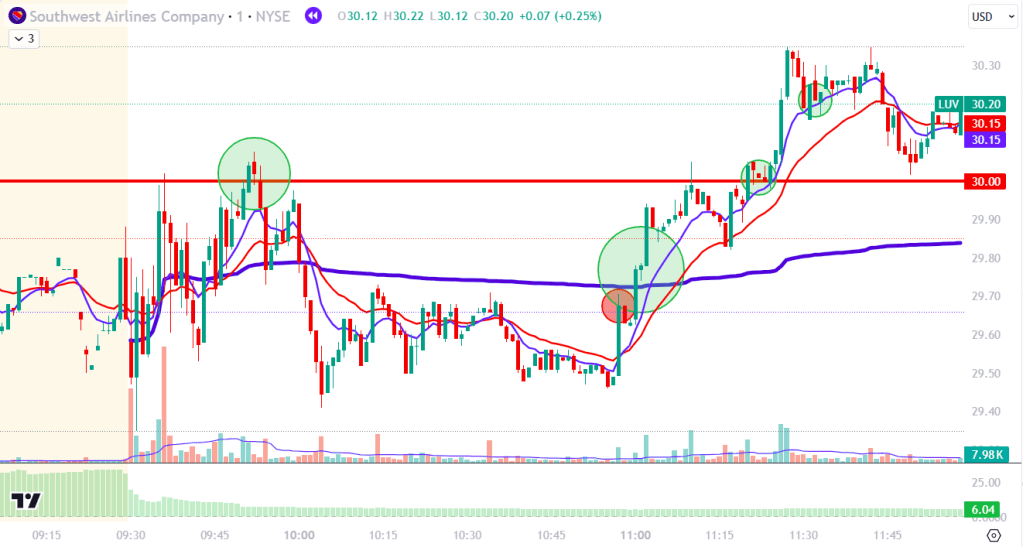

Below are my morning trades on LUV. Green circles denote long entries and red circles denote short entries.

LUV did not open as strong as I would have liked. Unlike GME’s opening drive in my previous trade review, LUV’s price action was very volatile and did not respect VWAP. When we finally moved above VWAP, I was hesitant to enter a long trade until we cleared the $30.00 resistance level. Once I thought we were holding above that level, I entered long with a stop a few cents below $30.00 but was unfortunately stopped out.

Around 11 a.m., the price came right into VWAP, rejected it, and started to hold. I entered a short position with a stop above VWAP but was stopped out. I immediately entered a long position because I’ve noticed that large candles, whether bullish or bearish, that clear through VWAP with no pushback tend to continue in their respective direction. I entered long, took profits after the initial move up, and closed my position just below $30.00.

When we broke above $30.00 and started to hold, I entered long with a stop at $29.98. I was stopped out to the cent, and then the price took off without me. In hindsight, I should have re-entered on the close of the candle that stopped me out. Instead, I waited for consolidation on lower volume, thinking it was a pullback and the price would continue, but unfortunately, it did not, and I was stopped out again.

Reflecting on my trades, I believe my strategies were sound, but my execution needed improvement. Here’s a breakdown of what I could have done better:

- First Trade: I should have waited for confirmation that $30.00 was holding as support before entering the long position. Entering prematurely led to an unnecessary stop-out.

- Second Trade: Given the high volume on the previous bullish candle, I should have been more cautious about entering a short position. The strong bullish momentum indicated that the short might not hold.

- Third Trade: My stop was too tight. Allowing a bit more room for fluctuation could have prevented an early stop-out.

- Fourth Trade: I anticipated a continuation that never materialized. Recognizing the lack of follow-through sooner would have helped avoid this loss.

The opening drive for LUV was weak, and this type of volatile price action is something I will avoid in the future. Additionally, I would rate this catalyst a 5 at best. While it brought significant relative volume, the catalyst lacked a clear directional bias, unlike strong earnings reports which provide more predictable movement.

Leave a comment