Pre Market Prep

Fundamentals

Two weeks ago, AT&T and AST SpaceMobile announced a commercial agreement to launch their first space-based broadband network, providing direct connectivity to everyday cell phones. This summer, AST SpaceMobile plans to deliver its first commercial satellites to Cape Canaveral for launch into low Earth orbit. These initial five satellites will enable commercial service, following several key milestones already achieved. AT&T will continue collaborating with AST SpaceMobile on developing, testing, and troubleshooting this innovative technology to ensure satellite coverage across the continental U.S.

In a significant development this morning, AST SpaceMobile secured a $100 million commitment from Verizon Communications (VZ) as part of a new direct-to-cellular partnership. Under this agreement, AST SpaceMobile will provide direct-to-cellular service to Verizon’s customers, aiming for comprehensive coverage of the continental U.S.

Being supported by two major cellular service providers, AT&T and Verizon, positions AST SpaceMobile to establish a substantial footprint in U.S. satellite coverage.

Technicals

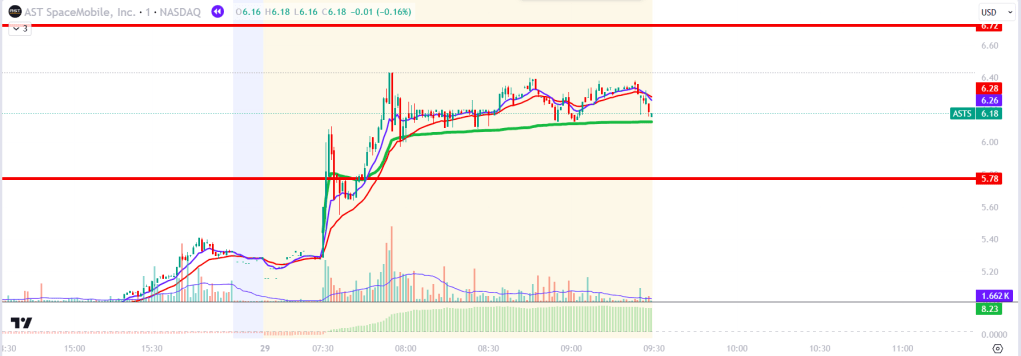

As illustrated in the chart below, we experienced a significant gap up in the premarket accompanied by high relative volume, nearly eight times the normal level. This indicates increased interest in this stock. By anchoring the VWAP to the initial volume spike in the premarket, it becomes evident that buyers were clearly in control throughout the premarket session.

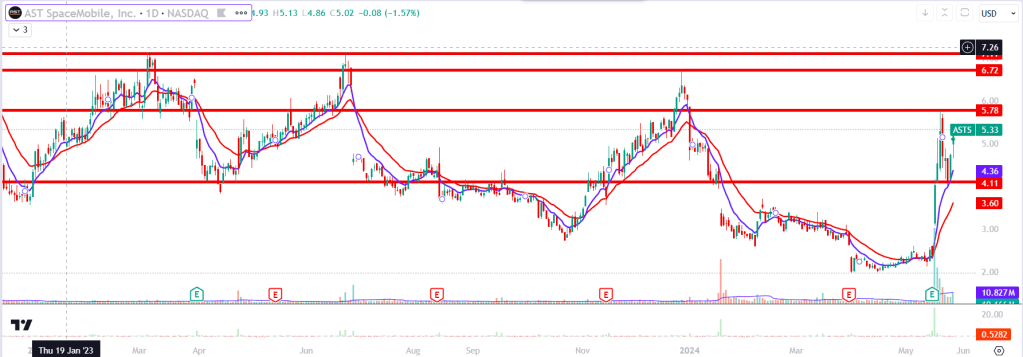

Below is the daily chart, highlighting some long-term resistance levels we might encounter during the trading day. Notably, we have already surpassed the 5.78 level in the premarket.

VWAP with 9/21 EMAs Strategy

- The stock must have a fresh news catalyst.

- The stock must be trading at an elevated RVOL.

- Long above VWAP and short below VWAP

- Use 9 and 21 EMAs as trend lines. Enter above 9 EMA and exit below 21 EMA.

Post Trade Review

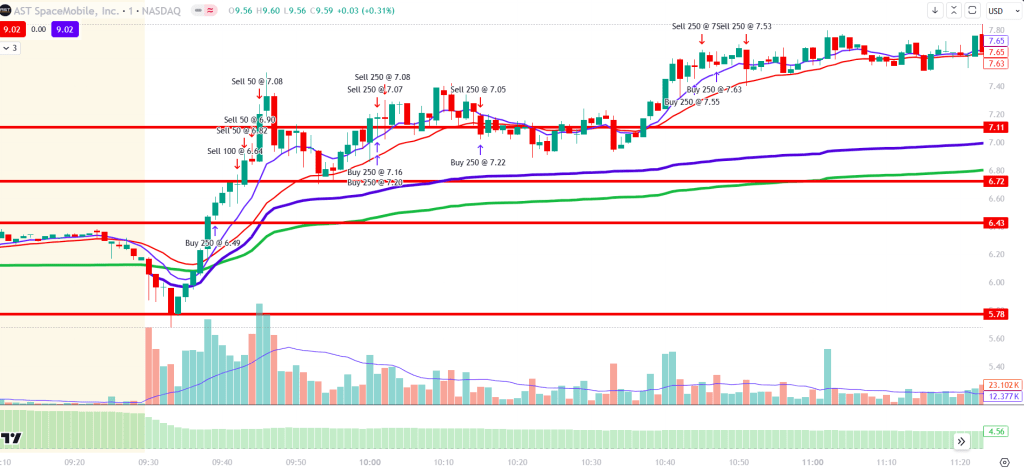

At the open, we immediately saw selling into the 5.78 level that we had broken in the premarket. The price bounced off this level and began using it as support. I didn’t enter the trade when we broke through the two anchored VWAPs (the green VWAP is anchored to the premarket, and the blue VWAP is anchored to the market open). I hesitated to purchase immediately because we were just below the premarket high, and I wanted to see if we would break this level.

In hindsight, I need to recognize that the premarket high is not very significant, especially when there is a fresh news catalyst. I eventually entered the trade with a position size of 250 shares when I saw it holding the premarket high as support. I set my stop right below that level (about 6 cents) and took 100 shares off at the first resistance level. I then proceeded to take profits and went flat when I noticed what I believed to be a short squeeze—a large bullish candle on high volume that broke through a significant level.

Although this trade worked out, I have to admit it was partially driven by FOMO and just happened to be successful. Subsequently, I made several trades where I got stopped out. Multiple issues plagued these trades: I set my stops too close and should have placed them under significant swing lows. I became impatient and started to trade on tilt, which led to losing all my profits from the initial successful trade.

I need to remind myself not to trade on tilt. Patience is crucial, and if the price action looks messy, I should move up a time frame for a clearer perspective.

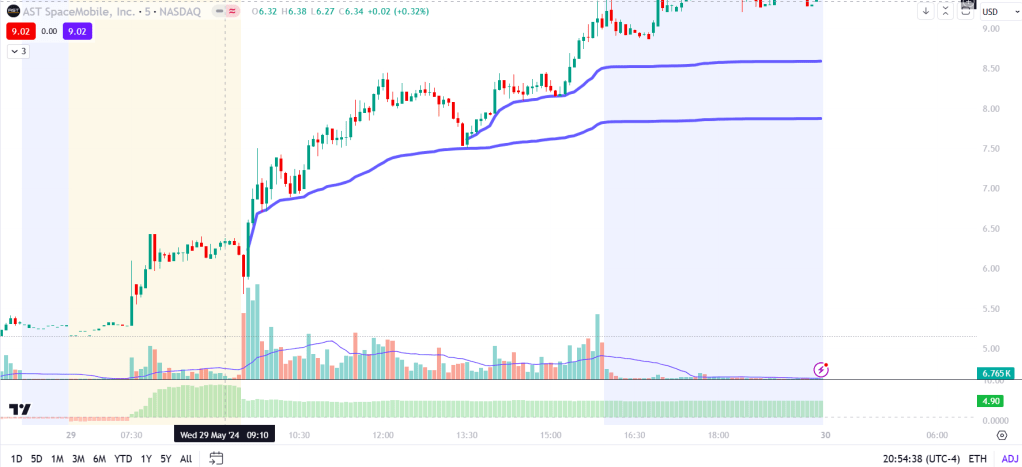

It’s remarkable how removing some of the clutter on the chart and switching to a higher timeframe can reveal the bigger picture. On the 5-minute chart below, it’s clear that we were trending upward all day. However, I let each minor tick in the other direction scare me out of the trade. Moving forward, I must start utilizing multiple time frames to avoid this issue.

Additionally, I need to be more flexible with my anchored VWAP. Price action may not always return to the VWAP anchored to the market open or premarket activity. As more participants enter the market, the price may never align exactly with the initial VWAP. As illustrated below, I anchored the VWAP to the low right before the significant upward move, and this VWAP was precisely touched later in the day.

As time goes on, I will continue to refine and enhance my VWAP strategy. If you look at previous blog posts, you’ll see that the VWAP strategy has evolved significantly. Only through continuous market exposure can I perfect this approach. Stay tuned for more updates.

Leave a comment