Pre Market Prep

Fundamentals

NVDA released earnings after the market close on May 22, 2024. As if this stock couldn’t get hotter, they absolutely crushed earnings and reported a record quarter.

| Estimated | Reported | Percent Difference | |

| Earnings | 5.6 | 6.12 | 0.52 (+9.30%) |

| Revenue | 24.593B | 26.044B | 1.451B (+5.9%) |

In addition to their positive earnings, they also announced a 10-for-1 stock split, effective in June. Stock splits are a great catalyst since they are effectively making the stock more affordable while also increasing liquidity – perfect for intraday trading.

Technicals

Below are some very important data points that I check before looking to trade any particular stock:

- Average daily volume = 45M shares

- ATR = 31.24

- Gapped Up = 6.9%

- RVOL = 5

These show us that this stock has the attention of a lot of participants. It is being traded more than usual and will provide the liquidity necessary to get into and out of positions.

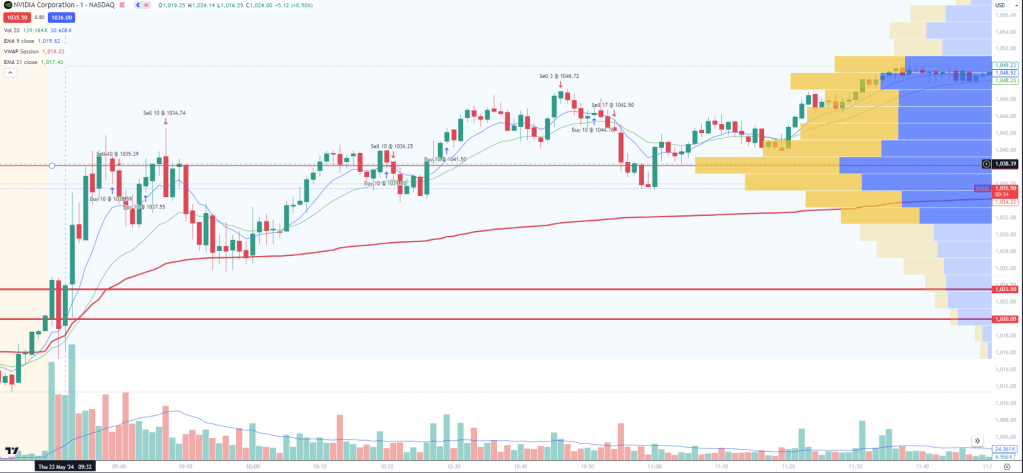

NVDA had a hard time pushing through the 958 level; however, after earnings it easily cleared that level of resistance. It then began to hit resistance again at the 1,020.00 to 1,023.50 range.

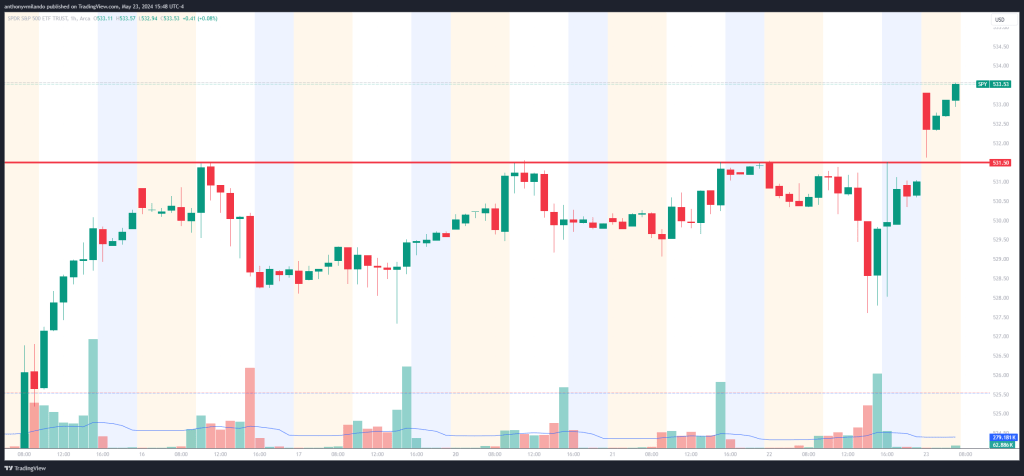

The SPY followed a similar story, clearly hitting resistance at 531.50 and then breaking out in the same fashion as NVDA.

Strategy

Long if price action comes to VWAP and moves away quickly or holds and doesn’t break VWAP.

Post Trade Review

I did not trade that well today. I did not stick to my game plan of purchasing near VWAP. You can see my first entry long was around the volume profile point of contention. I longed 10 shares, but was stopped out. I tried to do this again when price came back up above the 9ema (blue line), but again price could not break through that point of contention. After this, I had to hop in a meeting for my 9-5 and unfortunately missed the VWAP touch. When I got back to my computer to trade, I tried to long two more times near the point of contention. My first attempt failed, but my second appeared promising. My issue was I did not know where to take profit. I sold 1/3 of my position at 1046.72 and then purchased another 10 shares (now holding 17 total shares) when price looked like we were holding between the 9ema and 21ema (red line). I got out of my trade when we closed below the 21ema on decent volume. (going to use this as a ReasonToExit trades going forward)

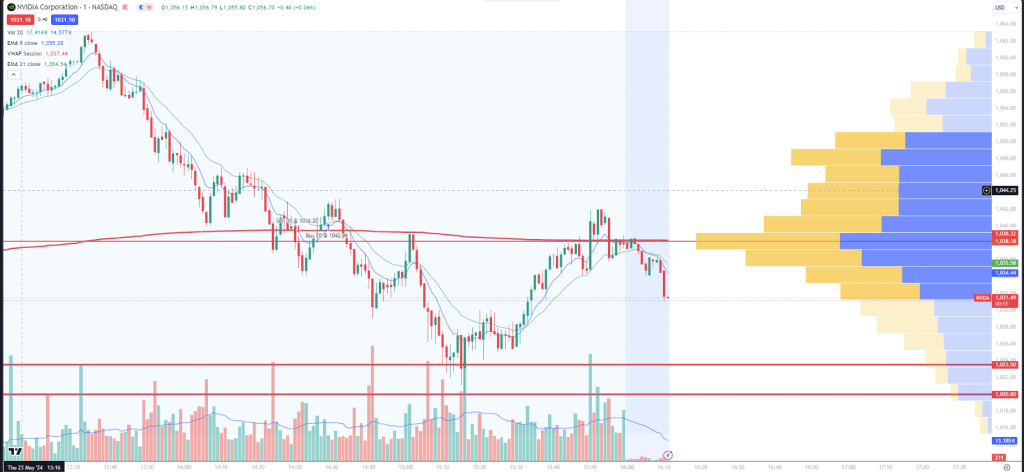

I had a busy workday, so I was unable to trade after these failed trades, which was unfortunate because NVDA made its way 20 points higher. Later in the day around 2:30pm, I shorted when price action crossed VWAP, which also coincided with the point of contention. I got stopped out, but the trade did end up working on the second time. Unfortunately, I was not involved.

Going forward, I need to stick to my strategy. If I want to trade the trends or pullbacks, I need to go over that prior and state exactly how and when I want to get into the position as well as where my stop should be. I should not enter a trade if I do not at least know these two variables. Trading VWAP would have worked very well, if I traded it correctly. I also noticed that there may be some edge in trading an ema crossover. I plan to look more into this via trading view’s pinescript backtesting. Tomorrow is another trading day, and we may be able to play off the 2 day VWAP on NVDA.

Leave a comment